OTHER WAYS TO GIVE

Enterprise Zone Tax Credit

Colorado's Enterprise Zone (EZ) program provides tax incentives to encourage job creation and capital investment in economically depressed areas of the state.

This program makes it possible for Habitat for Humanity of Metro Denver to offer its donors a Colorado state income tax credit for eligible donations that support our initiatives in the Enterprise Zone areas.

Does my donation qualify for an EZ Tax Credit?

Cash and stock gifts made to Habitat for Humanity of Metro Denver this calendar year may be eligible for the tax credit if the gift is:

- Valued at $250 or more.

- Made by a state of Colorado taxpayer directly or via a third party with 501(c)(3) tax-exempt status.

- No benefits were received in exchange for the contribution.

- Received by Dec. 31st, OR before Habitat reaches its yearly tax credit limit on qualifying contributions of $750,000 (whichever occurs first).

- Designated to one of our Certified Contribution Projects:

- Workforce Housing Project | Denver (including Clara Brown Commons, Platte Valley, Home Repair, and GES Coalition)

- Miller Homes | Wheat Ridge

- High Street Row Homes | Denver

- Navajo Street, new office | Denver

What are the benefits of an EZ Tax Credit?

Donors who make a qualifying contribution to Habitat for Humanity of Metro Denver may claim an income tax credit of 25% on cash donations and 12.5% on stock gifts, up to a maximum yearly credit of $100,000.

How do I take advantage of an EZ Tax Credit?

- Donate $250 or more to one of our Certified Contribution Projects by Dec. 31st.

Eligible donations will receive the tax credit on a first-come, first-served basis until Habitat’s annual contribution limit of $750,000 limit is reached. - Email donations@habitatmetrodenver.org, or call 720-382-1717, with your Federal Employer Identification Number (FEIN), Colorado Taxpayer Account Number, or the last four digits of your Social Security Number.

Habitat is required to report this information to the state of Colorado in order for your contribution to be certified. - Retain the DR 0075 Form you receive from the Enterprise Zone Administrator and file it with your Colorado State Income Tax Return.

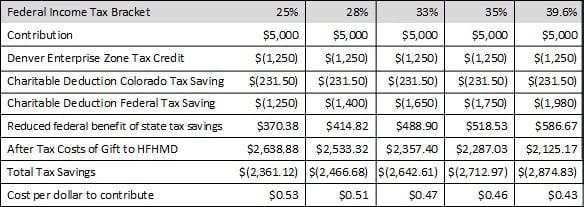

Savings Example

Information provided by EKS&H Material. This should not be considered tax, legal or investment advice. (Please consult your personal tax advisor.)

How can I learn more about the EZ Tax Credit?

Please email donations@habitatmetrodenver.org, or call 720-382-1717, read this Income Tax Topics reference, or visit the Colorado Department of Revenue website and search for “FYI Income 23.”